The Curious Case of UK Property: A Market Flip

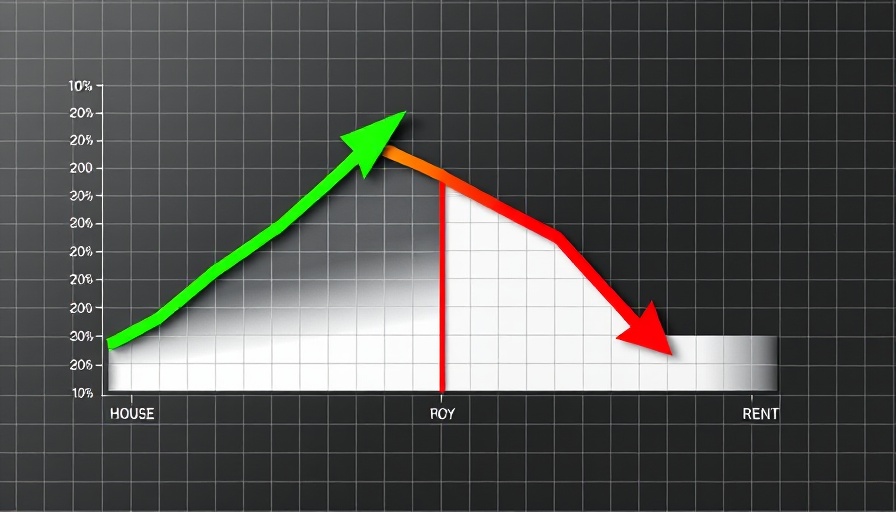

In the recent upheaval of the UK property market, we find ourselves navigating a perplexing landscape where house prices have reached record highs, yet rental rates are inexplicably on a downward trajectory. The latest insights reveal troubling contradictions that challenge our traditional understanding of housing dynamics.

In 'Something Strange Is Happening to UK Property', the discussion dives into the peculiar dynamics of today's housing market, exploring key insights that sparked deeper analysis on our end.

Understanding the Two-Lane Road of the Property Market

Imagine the property market as a two-lane road—one lane for buying and another for renting. In typical circumstances, when mortgage rates are low, the buying lane becomes busier, alleviating pressure on the renting lane and keeping rents stable. Conversely, high mortgage rates usually push more individuals into the renting lane, causing rents to rise in response to increased demand.

However, today’s market tells a different story. With mortgage rates soaring from 1.95% in 2022 to 4.84% in 2023, the increasing cost of borrowing means fewer people can afford to buy homes. A £300,000 loan at today’s rates would set borrowers back approximately £1,210 per month, leaving many potential buyers stuck in the rental market. This should have led to a surge in rent prices, yet interestingly enough, the opposite is occurring.

Inflation vs. Real Value: The Hidden Crash

Analysts suggest that what appears as rising house prices is an illusion when adjusted for inflation. If inflation has led to a 15% devaluation in purchasing power since the market's peak, it follows that despite nominal price increases, real estate values have essentially rolled back to 2013 levels. To put this in perspective, if in 2021 you could buy 370 Fredo bars with £100, that same £100 now buys only 320 bars, reflecting a loss of purchasing power. The same is true for property prices that have risen on paper but have effectively been eroded by inflation.

The Rental Market: A New Normal?

While rents surged historically, with averages increasing by over £3,000 in three years, they have started to stabilise. The previous surge rate of 7.3% was unsustainable, as tenants couldn’t keep up with rent increases, eventually forcing even the most ambitious landlords to adapt. Currently, rental prices are finding a new equilibrium, particularly in areas like London where affordability limits have become serious considerations.

Location Matters: The Two-Speed Market

An examination of different regions reveals that the current slowdown in rental growth is not uniform across the UK. While London grapples with tenants unable to afford high rents, areas such as the Northeast are witnessing a steady rise in rental values. The upscale southern areas are stagnating, while more affordable regions, like the Northwest, still boast growth potential. This divergence highlights an essential aspect of property investment—location is paramount.

Opportunities for Investors: Stay Informed

Despite the strange atmosphere in the property market, it’s crucial for investors to seize opportunities amidst uncertainty. Higher rental yields and a stable mortgage rate landscape can mean sustained profitability in property investments. Remember, while headlines may predict doom and gloom based on raw numbers, discerning the fine print and adjusting for inflation provides a clearer picture.

Today’s market may seem fraught with contradictions, yet understanding its intricacies can position you advantageously. With greater awareness, young homeowners and aspiring investors can make decisions that nurture their ambitions in the ever-changing landscape of UK property.

Concluding Thoughts on Your Property Journey

In conclusion, while the landscape of the UK property market adjusts and settles into this new equilibrium, young homeowners must remain proactive. The current shifts present not only challenges but also unique opportunities for those willing to dive deeper into market analysis. Consider subscribing to our free weekly newsletter for the latest trends, insights, and valuable strategies to navigate this dynamic market. Embracing this knowledge can empower you to make informed decisions to enhance your home and property care.

Add Row

Add Row  Add

Add

Write A Comment